Content

If the balance in the petty cash account is supposed to be $75, then the petty cash box should contain $45 in signed receipts and $30 in cash. Assume that when the box is counted, there are $45 in receipts and $25 in cash. In this case, the petty cash balance is $70, when it should be $75. This creates a $5 shortage that needs to be replaced from the checking account.

Cash short situations can happen for a number of reasons such as theft, mistakes in recording transactions, or incorrect change given to customers. Cash over situations occur when businesses have more cash on hand than what was expected. For example, a company would be cash over $8 if its general ledger showed a balance of $200 for its cash fund but the company actually had $133 in cash and $75 in receipts (for a total of $208).

2 Petty Cash

The primary use of the cash over and short account is in cash-intensive retail or banking environments, as well as for the handling of petty cash. In these cases, cash variances should be stored in a single, easily-accessible account. This information is then used to track down why cash levels vary from expectations, and to eliminate these situations through the use of better procedures, controls, and employee training.

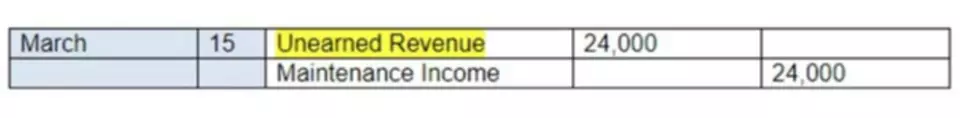

At this point, the petty cash box has $75 to be used for small expenses with the authorization of the responsible manager. The journal entry to establish the petty cash fund would be as follows. On the other hand, if the company has a cash shortage in the petty cash fund, it can make the journal entry with the debit of cash over and short account instead. Let’s assume Tom rang up a $100 pair of running shoes for $100, but he miscounted the cash received for the shoes.

Stay up to date on the latest accounting tips and training

For example, a bigger business might need to make multiple deposits during the day. Your cash drawer, also called a register or till, stores cash, coins, checks, and other valuable items (e.g., coupons) at the point-of-sale (POS). Balancing your cash drawer is an essential part of your business’s daily routine.

A controller conducts a monthly review of a petty cash box that should contain a standard cash balance of $200. He finds that the box contains $45 of cash and $135 of receipts, which totals only $180. This cash shortfall is recorded as a debit to the cash over and short account (which is an expense) and a credit to the petty cash or cash account (which is an asset reduction). A petty cash account is an account a company uses to pay for small expenses. A company creates a voucher each time the petty cash account is used.

What Is Cash on Hand?

For accountability purposes, assign one or two trusted employees to balance your cash drawer(s). You can assign one person to count the drawer while another employee prepares the cash short and over bank deposit. Have employees who manage cash drawers sign a report indicating they balanced the drawer. When balancing your cash drawer, look out for both overages and shortages.

Where is cash short and over on a balance sheet?

The cash over and short account is an expense account, and so is usually aggregated into the "other expenses" line item in the income statement.

Just like brushing your teeth, you should also be balancing your cash register drawer daily. Your cash flow forecast is actually one of the easiest formulas to calculate. There aren’t any complex financial terms involved—it’s just a simple calculation of the cash you expect to bring in and spend over (typically) the next 30 or 90 days. For small businesses in particular, cash flow is one of the most important ingredients in their financial health. One study showed that 30% of businesses fail because they run out of money.

The cash over and short account

Businesses may benefit from creating a cash flow projection, which is an estimate of the cash inflows and outflows in a specific period. Determining the balance on the cash flow statement can provide a more accurate account of the cash on hand that is expected. The operating expense burden can be calculated using the amounts reported on the income statement, but any non-cash expenses like depreciation and amortization (D&A) must be deducted. In short, the days cash on hand is the estimated number of days that a company can sustain its operations – i.e. pay off all of its required operating expenses – using only its cash on hand. The cash over and short is recorded on debit when there is a shortage.

Thus, this account serves primarily as a detective control—an accounting term for a type of internal control that aims to find problems, including any instances of fraud, within a company’s processes. The till also has an additional $12.78 in checks not recorded in sales. When check sales are lower than the total checks collected, it might be due to an employee ringing up a transaction under an incorrect payment method. A POS report will break down totals by category, like cash, checks, and credit card transactions. When it comes to balancing your cash drawer, your steps might differ from another business’s.

How to Handle Discounts in Accounting

The cash over and short account is used to record the difference between the expected cash balance and the actual cash balance in the imprest account. Sometimes the petty cash custodian makes errors in making change from the fund or doesn’t receive correct amounts back from users. These errors cause the cash in the fund to be more or less than the amount of the fund less the total vouchers.

What is cash over and short?

In accounting, over and short—or "cash over short"—implies a disparity between a firm's reported figures and its audited figures. It's also the name of the account where the firm records these cash discrepancies. Being over and short occurs most often in retail and banking.

Cash over situations can be thought of as the opposite of cash short situations. Cash over occurs when there is more cash on hand than what was expected/recorded in a company’s general ledger. The cash over and short account is a temporary account that is closed out at the end of the accounting period.

For example, a company with a $7 cash over entry would experience a resulting $7 increase in its net income for that period. If the voucher amounts do not equal the cash needed to replenish the fund, the difference is recorded in an account named cash over and short. This account is debited when there is a cash shortage and credited when there is a cash overage. Cash over and short appears on the income statement as a miscellaneous expense if the account has a debit balance or as a miscellaneous revenue if the account has a credit balance. In the journal entry below, the vouchers total $130 but the fund needs $135, so the entry includes a $5 debit to the cash over and short account. When the fund requires more cash or at the end of an accounting period, the petty cash custodian requests a check for the difference between the cash on hand and the total assigned to the fund.

- Conducting market research and making price adjustments may help boost sales.

- In all cases, the amount of the purchase using petty cash would be considered to not be material in nature.

- With a counting machine, you don’t have to worry about manually counting cash or change by hand.

- Credit, or decrease, your cash account by the amount by which you must replenish the petty cash account in the journal entry.

- For small businesses in particular, cash flow is one of the most important ingredients in their financial health.

When you count your till at the end of each shift or day, count your cash and total up your checks, credit card receipts, and other transactions. Before you begin balancing your cash drawer and accounting for any incoming cash flow, you need to print or access a POS report that details how much you should have in your till. Businesses that have a tendency to fluctuate or can’t clearly forecast their cash inflow during their growth stage should also set aside a decent amount for their cash on hand account to use as needed. Trends such as an increase in interest rates for business loans or inflation on capital goods can affect the amount of funds a business should set aside to cover possible future expenses.

SELECTED POSTS

This amount would be logged into the cash over and short account and result in a decrease of $10 for the company’s net income. A cashier working at a clothing store conducted a transaction in which the customer overpaid. The customer gave the cashier $60 for a purchase that should have only cost $50. The cashier did not notice this mistake and accepted the $60 as full payment. In this case, the extra $10 would be credited into the cash over and short account.

- Generally, the amounts in the account Cash Short and Over are so small that the account balance will be included with other insignificant amounts reported on the income statement as Other Expenses.

- As stated above, any discrepancy during this process goes into the cash over and short account.

- The cash flowing in would include sales from customers, while the cash flowing out would consist, for instance, of money paid to cover the cost of inventory.

- As this petty cash fund is established, the account titled “Petty Cash” is created; this is an asset on the balance sheet of many small businesses.

- To make the process less tedious, consider investing in a counting machine.